Jet Airways : What's going on ? Past Present & Future ... !!

So today we will do deep analysis of Jet Airways and tell you what's behind the soon to open doors of Jet Airways

Covers

📊 Timeline of events

📊 Financial Performance

📊 Resolution Plan Details

📊 How Equity Shareholders will loose 99% of wealth?

📊 Murali Lal Jalan interview highlights

📊 Future of Jet Airways : headwinds ahead

📊 Can it scale same sky heights again

Timeline of events

◾May-2018: Posted first unexpected loss in 11 quarters. Networth turns negative.

◾September-2018: Income Tax raided corporate offices.

◾October-2018: ICRA downgrades Jet Airways' debt.

◾December-2018: defaulted on debt repayment

◾March-2019: Naresh Goyal steps down from board.

◾April-2019: Shuts operations.

◾June-2019: NCLT admitted Jet Airways into IBC.

◾October-2020: Bid by Kalrock-Jalan consortium approved by CoC.

Financial Performance

◾There are no financials to discuss financial performance. Due to IBC, airline has not publish results for Ql, Q2, Q3 of FY21.

◾Last financials as on 31-3-20 shows auditor has given disclaimer opinion (means they are unable to give opinion due to lack of data).Beside that they have raised 10 grave issues in financial statements of co.

◾Resolution professional unable to publish consolidated results due to lack of data from group companies.

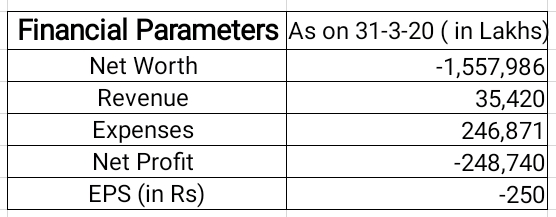

◾Financial position as on 31st-March-20

Above results highlights negative net worth, more expenses than revenue and many more.

Resolution Plan

The winning bidders Kalrock-Jalan consortium will pay Rs 1183 crore over five years to stakeholders (creditors, employees etc.) of airline. This amount is just 8% of Rs 15000cr admitted dues. The amount is also lower than current market capitalization Rs 1539 cr. Hence as per Murari Lal Jalan led consortium offer intrinsic value of share is lower by 23% of CMP,

Who is getting how much ? (in Cr)

What else?

◾Above Rs 1183 is not an upfront payment but will be paid from internal accruals, sales of assets and cash flow from operations once resume.

◾Consortium has offered to buy 51% Ethihad Airways' stake in Intermiles (Jet Privilege), loyalty programme unit and get another 41.5% stake through resolution plan while financial creditors will have 7.5% stake.

How Equity Shareholders will loose 99% of wealth?

Above is shareholding pattern of Intermiles not Jet Airways. Since lenders are getting paid only 8% of their claim , equity shareholder should not expect anything bright from new owners.

How existing shareholder will be at huge loss due to capital reduction or equity dilution?

So public or retail shareholding will be down from 25% to 0.21%. That’s 99% equity dilution or reduction. In other words 99% of wealth of current shareholder will be destroyed. For example if you currently hold 10000 shares of Jet Airways , after resolution plan you will have just 84 shares in new entity.

How this will happen ?

Existing paid up capital will be reduced and new shares will be issued to new shares so as to give him majority stake. This is called reduction / extinguishment / dilution of existing shares.

And this is not first time equity shareholder of stressed companies are in lurch.

Ruchi Soya Case: erstwhile shareholder get only one share in new Ruchi Soya against 100 shares in old Ruchi Soya

DHFL Case : Piramal plans to write off existing equity shares and delist it.

Then why share price rising : 1. technical reasons like high volumes. 2. New management's positive interview which hopes to resume operation soon.

Murali Lal Jalan interview highlights

◾Plans to resume operations in next 4-6 months ( earlier it was supposed to resume in summer 2021)

◾International operations will be resume by end of the year.

◾In first year airline will operate with 25 aircrafts.

◾Very positive on Indian aviation industry.

◾No funding or investor is required for next 2-3 years.

◾Everything is going on track and on time.

◾Govt has assured we will get back slots of erstwhile Jet Airways.

Future of Jet Airways : headwinds ahead

◾Most important issue is getting back slots (route rights) , since DGCA has already granted Jet Always's slots to other airlines after it shutdown in April 2019. Moreover other airlines also bought resources

◾Team of professionals like CEO, COO are yet to be hire since c nsortium has

no experience of airline.

◾Employees who lost most due to crisis may resist to work with it.

◾Airlines are already in loss due to low capacity , rising crude price. ( Indigo reported loss of Rs 627 crore with daily cash burn of Rs 15 crore.

◾NCLT is get to approve the resolution plan.

◾Around 40 legal cases are pending related Jet Airway.

◾Financial frauds and miscarriage done by erstwhile promoter needs to be clean from books which can lead to booking huge exceptional losses in future quarters.

Conclusion : Can it scale same sky heights again

There are many legal and operational hurdles on front of airline to resume operations. Further it will take years to be a profitable venture. Considering these factors along with 99% equity dilution for current shareholder it's better to avoid or sell it for now.

Thanks for reading. Subscribe our newsletter and Youtube channel for more deep and detailed analysis.

CA SUDARSHAN BHANDARI

Note : No content of this blog should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is for educational and informational use only. The Author accepts no liability for any interpretation of article or comments on this blog being used for actual investment. This is purely an information services, and any trading done on the basis of this information is at your own, sole risk.

mognaZunba Colleen Kennedy https://wakelet.com/@ulteovorcand889

ReplyDeletestanontugood